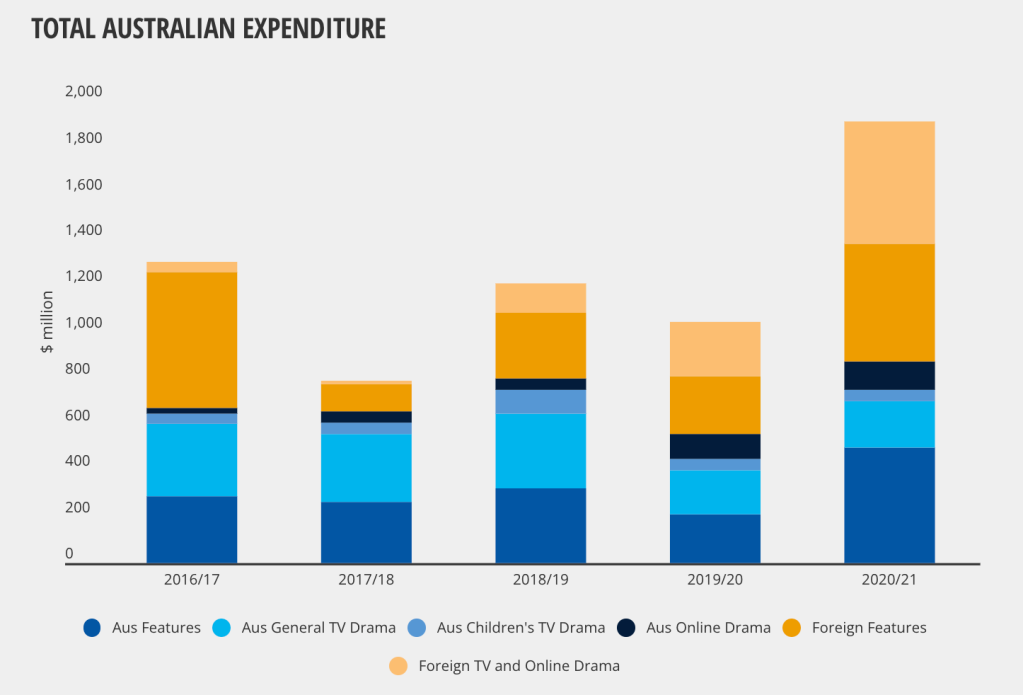

It’s no secret that Australia experienced a significant production boom during the 2020-21 financial year, but Screen Australia has finally crunched the numbers to reveal a record $1.9 billion was spent on drama production across the period.

The agency released its annual Drama Report yesterday evening, which details expenditure on all local and foreign drama production across film, TV, and online, as well in post-production, digital and visual effects (PDV).

The topline $1.9 billion is almost double last year’s spend, and more than 50 per cent above the five year average. Prior to, the biggest year for the drama sector was 2016-17, when spend reached $1.3 billion – again, due to significant international production.

Many newspaper inches were dedicated to the foreign projects and A-listers lured here during the summer months given Australia’s relative grip on COVID-19. International production spend, including post-production, tallied a whopping $1.04 billion across 63 projects such as Thor: Love and Thunder, Nine Perfect Strangers, La Brea and Escape From Spiderhead.

However, local production spend also reached a record high of $874 million from 95 projects, bolstered in part due to 23 productions that were delayed from 2019/20. However, the spend is not necessarily even, with free-to-air television production across both adult and children’s drama trending down overall.

Screen Australia CEO Graeme Mason has repeatedly said in order to understand the impact of the pandemic on the industry, both the 2019-20 and 2020-21 Drama Reports need to be considered in tandem. However, he suggests that, with support of government, the industry “came into its own” during this time.

“Last year would have been a record [if the pandemic hadn’t happened],” he tells IF. “This year, however, still would have been a record on top of that record.”

Foreign spend is always in flux – subject to the whims of the dollar, federal and state incentives, capacity, and now, the pandemic – but perhaps what differentiated the most recent influx of foreign projects was some level of Australian involvement.

Chris Hemsworth starred in Thor: Love and Thunder, and both produced and starred in Escape From Spiderhead. Australian producers Bruna Papandrea and Nicole Kidman relocated Nine Perfect Strangers from California to Byron Bay given the pandemic, with Papandrea’s Made Up Stories similarly moving Netflix series Pieces of Her – starring Toni Collette, David Wenham and Bella Heathcoate – from Canada to Sydney. Matchbox Pictures has serviced NBCUniversal projects like La Brea and Young Rock locally, while the company’s Paddy Macrae generated Irreverent which is shooting now.

The Drama Report notes that COVID-19 will disrupt some foreign production in Australia this year, though a number of projects are underway or slated to begin, including Nautilus, Ticket to Paradise and Young Rock season 2.

Given how pivotal Australians have been in driving international projects to our shores, Mason feels that the local industry can also claim some ownership of the recent foreign spend. While he doubts this year will be quite as big as last, it makes him confident that this is a not a “one-off” burst.

“It’s testament to the sector, first and foremost,” he says. “We’ve built up such a level of skill, but these people have also got to a point in their careers and reputation where they can influence decision makers.”

However, Screen Producers Australia (SPA) argued in response to the report that international production was driven by short-term environmental factors, and while it provided a welcome economic boost, the opportunities for local cast and crew were limited.

“These productions contribute a minimal amount to the building of sustainable local production businesses and do not enhance our ability to create Australian cultural content that speaks with a genuinely Australian voice,” said CEO Matthew Deaner.

In terms of Australian production, spend on features soared to a whopping $500 million – more than double last year’s spend, and 57 per cent above the five-year average.

However, the number of titles remained steady relative to the past five years – 38 domestic features and four co-pros entered production – suggesting the big boost in expenditure comes from Baz Luhrmann’s Elvis and George Miller’s Three Thousand Years of Longing. The vast majority of feature projects – 81 per cent – were made for budgets under $10 million. Only two projects were produced for less than $1 million, with Screen Australia only considering films with budgets less than $500,000 if they have a cinema release or major festival screening.

Mason acknowledges bigger projects skewed the spend, but says Screen Australia was really pleased to see the number of features produced recover out of the pandemic, even though some were holdovers from the year before.

Adult TV drama spend – excluding SVOD titles – only recovered 7 per cent from last year, with $201 million spent on 21 titles – that is 24 per cent below the five-year average. At 329, the number of hours was at the lowest point in five years.

Notably the production of mini-series, like SBS’s New Gold Mountain, ABC’s Fires and Nine’s Amazing Grace, did increase on last year, with titles up 38 per cent, hours 28 per cent and budgets up 29 per cent. However, expenditure only tallied $109 million, which is still far below pre-pandemic levels – in 2018-19 mini-series expenditure reached $202 million.

Given the suspension of local content quotas during the pandemic shutdown, and the subsequent relaxation of the drama, documentary and children’s sub-quotas, it is perhaps no surprise to see only seven children’s television projects entered production in 2020/21, six of which were produced by the ABC. The only commercial broadcaster to produce a children’s television show was 10, with Dive Club – co-financed with Netflix.

Kids free-to-air TV faced a 56 per cent decline in hours produced, while budgets dropped 23 per cent. Animated children’s titles – particularly cheaper animated content traditionally commissioned by the commercial FTAs – was particularly affected, with titles down 75 per cent, hours 77 per cent down, budgets down by 66 per cent and spend by 52 per cent.

However, overall spend on children’s was down only 7 per cent, suggesting what was produced had high production values.

“The projects that had some sort of scale to them are still being made,” Mason says.

“There’s no question: companies and creators, there’s fewer of them. But the other end we’re looking at, where kids are, and the content that they are consuming and watching – they’re still being serviced, because they are predominantly watching on the ABC and online.

“We are definitely going to fully expend our children’s budget this year without question. I know the ACTF is going to expend their full budget, including the extra money they got [at the federal budget].

“The availability of content for kids, that kids are consuming, hasn’t shifted as much as the impact on some of the creators.”

In terms of what Screen Australia calls ‘online production’ – which includes both projects SVOD platforms like Netflix and Amazon, as well as social media platforms like TikTok and YouTube – 25 projects generated $125 million. Some $116 million of that was from projects for subscription streamers, like Stan’s Eden, Acorn TV’s Ms FIsher’s MODern Murder Mysteries and Netflix’s Surviving Summer.

This year’s Drama Report captures a five year snapshot of SVOD spend in Australia for the first time, noting that over the period, budgets have risen from $800,000 to $13.5 million, and cost per hour from $530,000 to $3.3 million. Notably, the average cost-per-hour for a FTA TV drama this year was $619,000.

Screen Australia notes that currently the combined spend on drama by FTA and SVOD platforms is now at a level traditionally spent by the FTA sector alone, suggesting streaming service production is helping to adjust for ongoing declines in the FTA space.

SPA has welcomed the level of investment, with Deaner noting it “strengthens the case in favour of the appropriateness of ongoing safeguards which protect local investment from outside fluctuations.”

In terms of finance, the ABC made the largest contribution to Australian drama production of any a single broadcaster or SVOD platform, investing $43 million across 17 titles.

Combined, Seven, Nine and 10 contributed $54 million across 11 titles, while SBS/NITV contributed $6 million to four. Australian and foreign streaming platforms invested $30 million into nine titles. Subscription TV broadcasters – i.e. Foxtel – did not finance a title for first release that entered production in 2020/21.

In terms of the spread of expenditure across the country, New South Wales and Queensland snared the lion’s share, with 48 per cent ($912 million) and 29 per cent ($553 million) respectively. Unsurprisingly, given the Melbourne lockdown of late 2020, spend in Victoria dropped slightly to $307 million. South Australian spend dropped to $96 million, WA to $29 million, while Tasmania, the ACT and the Northern Territory collectively tallied $18 million.

As part of the report, Screen Australia also surveyed producers about the impact of COVID-19, with 74 respondents reporting additional budget costs totalling $17.9 million, or an average of $242,406.