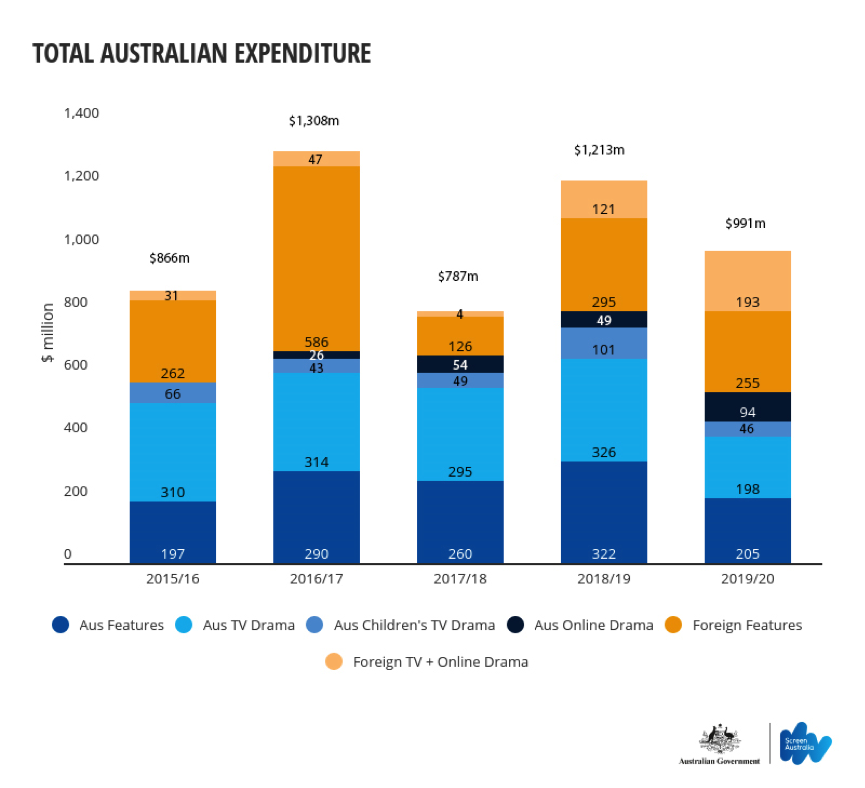

Despite the pandemic, there was still almost $1 billion spent on drama production in Australia in the last financial year, indicating the sector had been on track for a potential recordbreaker before it was interrupted.

That’s according Screen Australia’s annual Drama Report, released today, which details expenditure on all local and foreign drama production in 2019-20, across film, TV, and online, as well in post-production, digital and visual effects (PDV).

The topline figure of $991 million in total drama expenditure is just 18 per cent down on 2018-19. Notably, that number does include projects that began principal photography but entered into hiatus mid-March.

Not included are the 26 drama titles meant to shoot in 2019-20 that were delayed or postponed due to the pandemic, with budgets that exceeded $325 million.

Indeed, if those those had gone ahead, total expenditure would likely have neared or surpassed 2016-17’s record $1.3 billion.

The impact of COVID is most keenly seen on local titles, which generated $543 million from 74 projects, down 32 per cent last year’s all-time high. There were downward trends in features, TV drama and children’s spend. But despite everything, online production expenditure (which includes SVOD platforms) was up a staggering 95 per cent.

Foreign production spend, including on PDV-only projects, was actually up on the previous financial year; it generated $447 million, an 8 per cent increase. Broken down, $293 million was spent on the production eight features, two TV dramas and one online drama, down 5 per cent on last year, and $165 million on 30 PDV titles, up 39 per cent.

Screen Australia CEO Graeme Mason has frequently gone on the record to say had the pandemic not occured, Australia was looking at a record year in most areas.

The dip in local production spend he attributes almost entirely to COVID, and he expects to see numbers bounce back aggressively this year.

As he tells IF: “Considering we lost everything from mid-March to June 30, to be at just shy of $1 billion is really extraordinary.”

Reflecting on the report, Mason is proud of the industry’s “collaborative spirit” that has seen production restart in earnest in recent months. This includes the way agencies, AFTRS, guilds and other organisations banded together to create the COVID-Safe protocols, the government’s Temporary Interruption Fund (TIF), Screen Australia’s COVID-19 Budget Support Fund, additional state agency support, and the industry’s general willingness to share information and advice.

The executive notes almost every feature or adult TV drama put into hiatus or delayed has either gotten back up-and-running or is set to go soon.

Indeed, the industry is currently vibrant, with a serious number of large-scale projects underway or about to start including Young Rock, Blacklight, Escape From Spiderhead, Elvis, Nine Perfect Strangers, Three Thousand Years of Longing, Thor: Love and Thunder, Seriously Red, Gold, Eden, Bump and The Unknown Man, and the restarted Clickbait and Shantaram. In fact, there are some scheduling issues being borne out at the moment.

“At the moment it’s really hard to find crew and facilities, because so much is happening. You’ve got the normal stuff, plus the carryover, happening at once,” Mason says.

Of course, further headwinds remain for the industry in that many projects face added costs related to working in COVID-Safe way. Surveyed producers of titles with budgets over $1 million report cost increases ranging from the marginal to around 15 per cent of the pre-COVID budget.

Mason believes to get true insight into the pandemic and its after-effects, it would be logical to look at this year’s report together with next year’s.

Some 19 local features commenced production in 2019-20, including The Drover’s Wife: The Legend of Molly Johnson, Streamline, The Invisible Man and Penguin Bloom, and co-pros Falling For Figaro and The Power of the Dog.

Overall, they generated $205 million, 36 per cent down on the previous year.

Eight features had their shoot interrupted by COVID-19, while nine, with total budgets estimated at $250 million, are reported to have been postponed.

In total budgets came to $259 million. The vast majority of films, or 79 per cent, were made for under $10 million.

Notably, the proportion of projects made for under $1 million has declined steadily over the last four years – it now sits at less than 11 per cent, or just two projects.

“I think there’s many things at play there,” says Mason.

“People making low budget films, maybe they’re making them in different ways for different platforms. Maybe someone who’s got that kind of story they want to tell, or is looking for experience, may choose now not to make a low budget film. You might do it differently, and do it on an online platform.”

Foreign investors provided the majority of finance at $146 million, followed by the Producer Offset at $73 million.

According to the report, film titles that had to shift to 2020-21 faced various disruptions to financing. One title lost access to international actors, which pushed the budget down, while others sought out additional finance to cover projected budget increases of 10 to 15 per cent.

Twenty adult TV dramas went into production last financial year, totalling 351 hours, and generating $198 million in spend, down 39 per cent on last year’s record high.

They included Halifax: Retribution, Wakefield, and Mystery Road, as well as lockdown dramas Retrograde, Housos Vs Virus: The Lockdown and At Home Alone Together.

Five shows had their shoot interrupted due to COVID, while seven, with combined budgets of $45 million, were postponed.

For series/serials (defined as any series over 13 hours), the average cost per hour was down at $350K. Yet for mini-series average cost per hour rose to $1.65 million, up 12 per cent on last year and the highest number in five years.

The trend towards premium TV is not going to go away, and rising costs of production a global phenomenon.

In this sense, Mason says the increased Producer Offset for TV (from 20 to 30 per cent) should be a boon for producers going forward. He suggests Screen Australia will also use some of its additional funding to ensure projects of the scale audiences expect can continue be made.

The 2019-20 year saw 12 children’s dramas enter production, budgeted at $52 million, spending $46 million and generating 78 hours of content. Spend was down 55 per cent, budgets 52 per cent and hours 51 per cent off the back of last year’s six-year high.

Only one children’s series was put in hiatus due to COVID-19, while two were postponed, with budgets more than $10 million.

As is the norm, the ABC was the largest commissioner of kids content, ordering seven of the titles. Seven financed two, Kitty is not a Cat (season 3) and Tales of Aluna, as did Nine in The Gamers 2037 and Space Nova (with the ABC). Network 10, Disney Junior and NITV financed one each.

Some 23 online titles went into production, with total spend $94 million; an increase of 95 per cent. They included Netflix’s Clickbait, Stan’s Bloom and The Commons, and ABC iview’s Why Are You Like This?

Two online dramas had their shoot interrupted by COVID-19, while eight projects, with budgets of $20 million, were postponed.

Across the entire television and online slate, foreign investment provided the largest slice of the finance pie, at $117 million. As a proportion of total finance, this is the highest amount since 2001-02.

“There is so much interest in working in Australia, with Australian talent or filming here with our locations and crew,” Mason says.

“There’s a lot of focus on us to not just be a physical location, but to be creatively involved in the DNA of shows for overseas companies.”

In terms of commissioning platforms, the commercial free-to-air networks provided the largest collective contribution to this year’s slate: $61 million for 18 titles, representing a 43 per cent drop from last year.

Australian and foreign online streaming services were the second-largest collective of financiers with a combined contribution of $46 million in six titles – three by Stan, and one each from Amazon Prime, Netflix and Adult Swim. This is the first time this group of investors has contributed more than the public broadcasters.

The ABC invested $33 million in 14 titles, representing a 37 per cent drop from last year – the most finance of a single network.

Finance from subscription television broadcasters (like Foxtel) was up by 45 per cent on last year’s low, though still below the five-year average.

The increase in foreign production expenditure is attributed to the low Aussie dollar, the government’s Location Incentive Program (into which it has since pumped an extra $400 million), and the state PDV rebates. International projects included Shang-Chi and the Ten Rings, Shantaram, Children of the Corn and Nomad.

As is typical, New South Wales and Victoria accounted for the majority of production spend at 48 per cent and 28 per cent respectively.

Thanks to projects like Mortal Kombat and its competitive PDV rebate, South Australia snagged 15 per cent of the national share, or $146 million. Queensland captured just 5 per cent ($53 million), the lowest share since 2012-13; the result of Baz Luhrmann’s Elvis being delayed and a lack of large-scale international projects.

Western Australia drew in 3 per cent of all production ($34 million), while ACT, Tasmania and the NT accounted for the remaining expenditure of $4 million.

Read the full report here.