There are positive signs for film and free-to-air television in PwC’s annual Media and Entertainment Outlook, which shows both sectors experienced a resurgence in 2021.

According to the report, released today, 2021 was a year of unprecedented growth in the industry with consumer spending up 6.23 percent from the prior year, reaching $45.6 billion — the highest single-year leap in the history of the outlook.

Of this, $31.6 billion was spent on internet access, while games and subscription TV made up nearly 60 per cent of the remaining $14 billion.

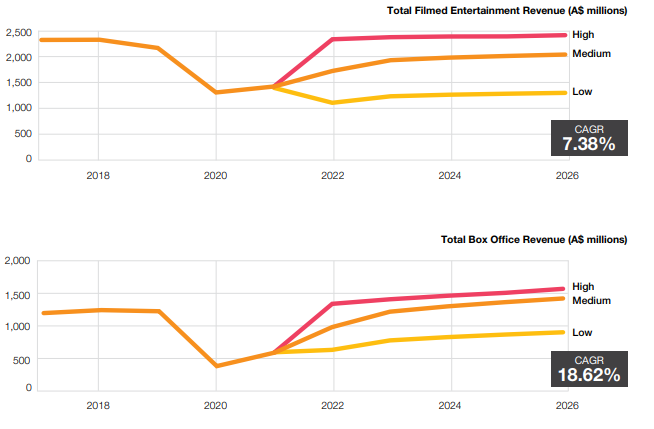

The growth extended to filmed entertainment, which PwC noted had moved into a period of “fluid recovery”, increasing 8.7 per cent from the previous year.

Data from the company indicated box office revenue grew 50 per cent from the previous year to reach $605 million in 2021, following a 67.3 per cent year-on-year decline in 2020.

As stated in the report, this has been due in part to studios and distributors working through the pandemic-induced backlog, including Spiderman: No Way Home ($55.7 million in 2021) and No Time to Die ($34.3 million). The outlook forecasts box office revenue to return to pre-pandemic levels by 2023 with a total of $1.22 billion.

Exhibitors referenced in the report have cited that up to 90 per cent of frequent moviegoers have been back, albeit on a less frequent basis. PwC believes engaging lower frequency consumers and older audiences continues to be a challenge for operators, though it believes increased diversity of the 2022 movie slate may change this.

Other key obstacles facing the industry, according to the outlook, include the “accessibility and widespread distribution power” of streaming platforms, which has led consumers to demand more from their out-of-home experiences, as seen by greater uptake of more premium in-cinema viewing, such as Hoyts LUX or Event Cinemas’ Gold Class.

Hoyts is among the industry players spending big on audiovisual infrastructure to ensure it offers an enhanced alternative, reportedly committing $250-300 million in the last eight years on capital improvement.

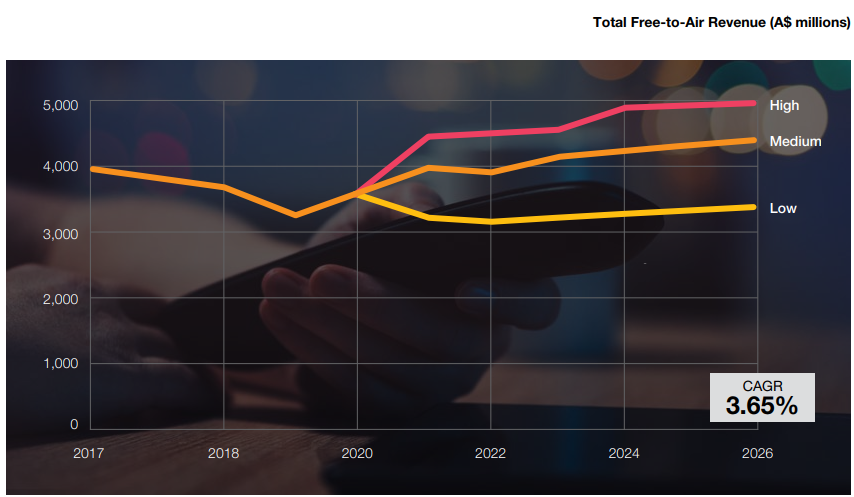

Like filmed entertainment, free-to-air television has also felt the impact of changing audience habits throughout the past few years, as viewers are provided with more options across terrestrial FTA, broadcaster and SVOD services.

Following a decline 12.1 per cent to $3.1 billion in 2020, the market rebounded to reach $3.7 billion in 2021, representing a growth of 12.6 per cent.

PwC expects the revival of the FTA market to continue throughout 2022, with further forecast growth of 7.9 per cent.

Among the key shifts in the sector last year identified by the report was the prominence of ‘Total TV’, in which networks no longer referred to a separation between linear TV and BVOD – a driver of which is believed to be the rise in people streaming linear through BVOD.

In the SVOD market, PwC data shows 75 per cent of households were paying for

a streaming service in 2021, a number that is expected to rise to over 80 per cent by the end of 2022.

Overall, the Australian sector was valued at $4.82 billion in 2021, with the average household spending $40 per month on video streaming services, rising to $55

when all forms of entertainment subscriptions are included.

Netflix, which recorded a decrease in subscribers for the first time in a decade earlier this year, was the top-ranked service in Australia, reaching more than 12.8 million Australians (14+), according to Roy Morgan research released in early 2022.

Foxtel services retain second spot with a reach of 7.1 million , while Stan, Amazon Prime and Disney+ are each watched by more 4 million people on a monthly basis.

PwC Australia director and Australian entertainment and media outlook editor Dan Robins said whereas the initial wave of the pandemic may have been characterised by households reigning in spending, 2021 saw consumers turn to entertainment and media more confidently.

“As in-person events return, this spending is likely to extend alongside habits around subscriptions, gaming, and access to content likely to stick,” he said.

“It was broadly believed consumers were stockpiling savings and consumer spending may have been down, given that in-person events are still only steadily returning and crowds returning through late 2021 and into 2022, this is certainly not the case.

“Digitised entertainment and media has entwined itself in our daily lives, and people are consuming content across more devices, at all times of the day, in all types of places,” said Robins.