The production boom shows no sign of slowing down: More money is being spent on drama in Australia than ever before, and significantly, the majority of spend is occurring on local projects.

Screen Australia’s annual Drama Report, released today, shows a record $2.3 billion worth of expenditure in 2021-22 across 162 productions, spanning film, TV (including SVOD), and online, as well in post-production, digital and visual effects (PDV).

Some $1.5 billion of that $2.3 billion figure – or 66 per cent – was spent on Australian drama. That is almost double last year’s then local expenditure record of $874 million.

Screen Australia CEO Graeme Mason tells IF it is an incredible result that speaks to how truly busy the industry has been of late, particularly given that the Drama Report – limited to scripted expenditure – is estimated to capture only around 30 per cent of activity within the Australian production sector.

“I’m thrilled that such a huge percentage, two thirds of the record spend, is on local Australian [projects],” he says.

“What it’s really being driven by is the high regard our creators, producers, writers, directors and crew have got.”

In part, the big uptick in local production expenditure comes via theatrical features. A record $786 million was spent on film in 2021-22, compared to 2020-21’s $495 million. This comes despite the fact the number of features that are being produced for cinemas is actually decreasing; just 24 titles entered production in the past financial year, 35 per cent below the five year average.

It follows that what films are being produced have high budgets. The report states five titles of the 24 were made above $20 million, making up more than 87 per cent of the total budgets. Most projects were made for more than $5 million, while the number of titles made for under $1 million continues to decline (now less than 8 per cent).

Notably, the year’s biggest features all came from name directors bringing projects back home to Australia: George Miller with his Mad Max prequel, Furiosa, Michael Gracey with Better Man and Garth Davis with Foe.

Mason posits that a smaller number of features being produced for cinemas is a reflection of the global market; that smaller, independent films have become more difficult to finance and distribute theatrically.

“We’re going back to the cinemas, but not at the same level for the same content yet, that’s both here in Australia and around the world.

“A great example would be The Stranger. Obviously it was made to play here in cinemas, but then there was a worldwide deal with Netflix and it’s now their number three English-language title in the world. The content is still incredibly in demand – if not even more in demand as that’s showing – just in a different space.

“That shift that was happening pre-COVID accelerated exponentially during COVID, and I think that’s going to continue at least for a while.

“There’s still room for smaller films; we’re really excited that we’ve got Sweet As coming up, Jub Clerc’s great film, which won prizes here and internationally. That’s a personal, smaller story, but you can see how or why an audience will want to go to the cinema together with friends and see that. We’ve got to lean into that brilliant experience that only the cinema can give you as a destination to go to with others.”

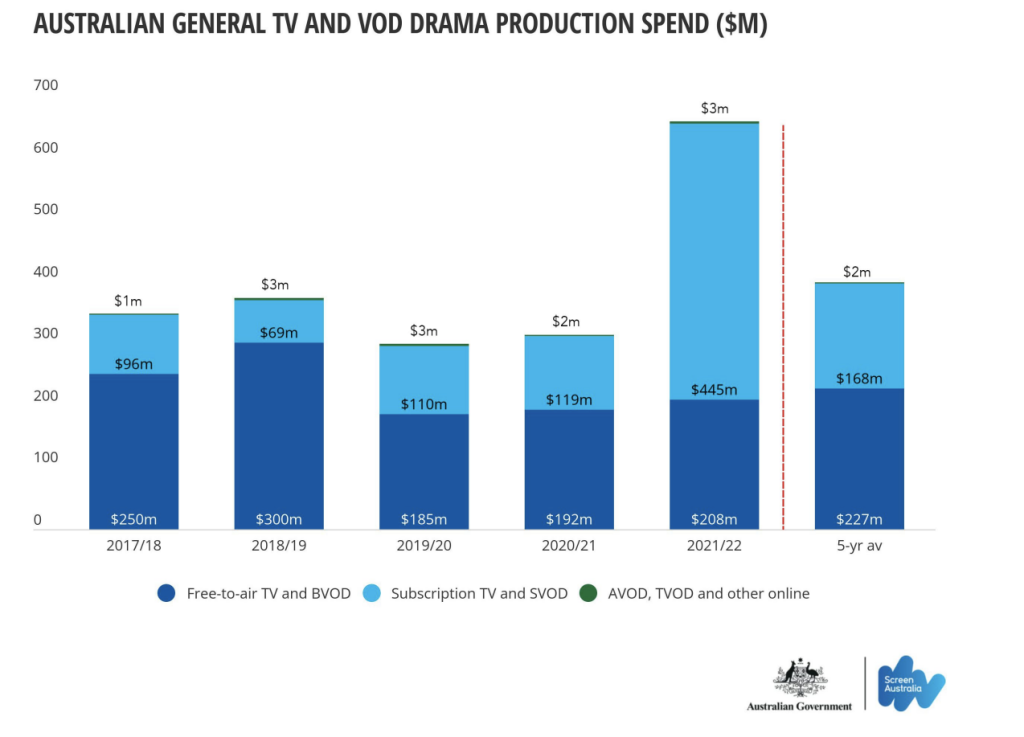

Spend across subscription TV and SVOD (i.e. projects for platforms such as Binge/Foxtel, Disney+, Netflix, Paramount+, Amazon Prime Video and Stan) also reached a record high of $445 million in 2021-22, generated from 29 titles.

The number of titles, hours and budgets for these platforms have tripled since the previous financial year.

In terms of first-release platform, Stan had the most titles enter production with seven (including Nine co-commission, Bali 2002), and also boasted the most hours at 25. Paramount+ had four titles, tallying 23 hours, as did Netflix, tallying 22 hours, and Amazon, tallying 21 hours. The average cost per hour for subscription TV/SVOD dramas was $3.3 million.

Mason is buoyed to see more SVOD platforms entering the Australian market and commissioning local productions, but cautions of the result: “one year does not a pattern make yet”. In particular, he notes it captures some “bleeding” between SVODs that are affiliated with an FTA channel, like Nine and Stan, or 10 and Paramount+.

“I can’t stress enough, we’re thrilled. But you’ve got some things that moved perhaps from free-to-air to SVOD, like Five Bedrooms, or things that could have been, in the old days, on the main channel. Nine and Stan do some co-commissioning as well,” he says.

“Stan is also trying to differentiate itself by being very local, I would suggest. And all the other streamers, they have to have local shows; we all love watching the brilliant English and American shows on those platforms, but we also do want to see ourselves and hear our voices. I think it would be foolish of them not to continue to invest in local stories.”

FTA and BVOD adult TV drama spend increased from last year to $208 million, but has not returned to highs seen before the sub-quotas were suspended on commercial FTA TV. Of the 24 drama projects made in Australia in 2021-22, a whopping 19 were made by public broadcasters.

Hours for drama on FTA also reached a record low of 278. Screen Australia notes hours have been in steady decline since 2001-01, when 715 hours of drama was produced. With Neighbours having ended, one may assume that hours will plummet further in the 2022-23 report, with the serial typically generating 120 to 130 hours of production per year.

Cost per hour for mini-series production for FTA/BVOD (i.e. a series less than 13 hours) was up 12 per cent, at $1.9 million – the highest in five years. This is well above the cost per hour for long-running series/serials, which is at $300,000.

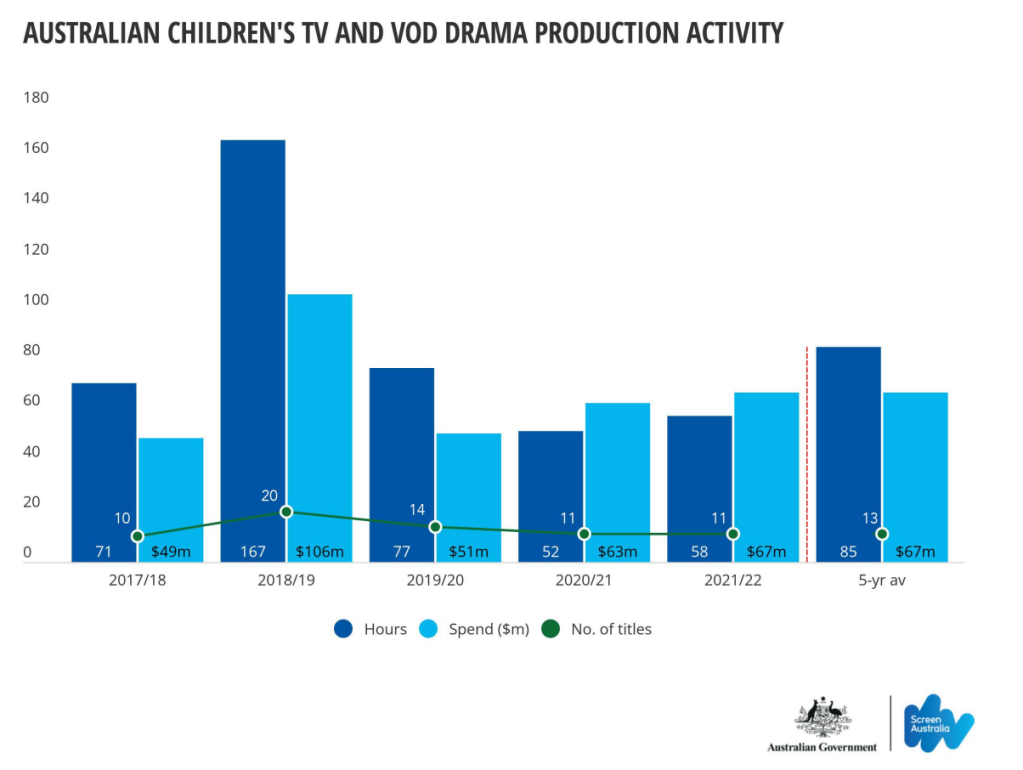

Screen Australia has changed how it measures children’s production expenditure in the current report, considering spend across all platforms, including SVOD and online platforms such as YouTube. Despite the change in classification, results in children’s were largely consistent. As per 2020/11, 11 titles entered production, generating $67 million (a 5 per cent increase). While hours increased by 12 per cent to 48, they were still below the five year average of 77.

Of the 11 titles to enter production, eight were financed by the ABC. The others included NITV’s Barrumbi Kids, Network 10’s Rock Island Mysteries and Netflix’s Gymnastics Academy: A Second Chance.

Mason notes the paradox facing the kids sector. On the one hand, Bluey is currently one of the most popular children’s series in the world. Having just returned from MIPJunior, he notes its success has rubbed onto Australian projects as a whole, with Beep and Mort and Crazy Fun Park generating incredible interest – “[Crazy Fun Park] was the most watched thing at MIPJunior in the tape library.”

On the other hand, he says that Screen Australia, the Australian Children’s Television Foundation and the ABC “are doing all the lifting”.

“What I would be very keen to see is all the other platforms, especially those new players here, beginning to operate in the space. I think it makes cultural and commercial sense for them because people are going to be choosing, in these tougher times, what subscriptions you keep; so one that is offering a range of content to the whole family, I think is essential, commercially. And then I suggest creatively, morally and culturally they should be there.

“But also what we’re looking at here at Screen Australia is: What are we doing in all those other platforms where kids are watching stuff now?

“I’m thrilled with incredible creators we’ve got in the kids area. I understand some of the stresses they’ve had of late, but my thing is to ensure that kids have content to watch, where they’re watching it. That’s the number one thing.”

In terms of finance contributed towards all TV/VOD projects, in 2021/22, the ABC invested $50 million, SBS/NITV $8 million, the commercial FTAs $41 million, subscription TV broadcasters (Foxtel, Fox Networks and Disney Junior) $13 million and streaming services $186 million (up from $30 million last year).

Notably, the Producer Offset made up 22 per cent of total finance across all TV produced, at $163 million – more than double the five year average. This reflects the lift of the TV PO from 20 to 30 per cent.

Mason also highlights the strong levels of inward investment into Australian projects, noting a large Australian sector is impossible to maintain without it. Foreign investment made up 44 per cent of total finance on local features, and 39 per cent in TV (though investment in ten of the 46 TV titles contributed to 62 per cent of foreign contributions).

“Things are getting more expensive to make. Inflation and everything is really tricky,” Mason says

“What we really want to keep seeing is that money coming in on shows. Hopefully that will make them be the best they can be and help them travel out, which means they get seen – my number one focus – but they also hopefully return some money back to the local sector and keep the cycle going.”

Overall spend on foreign projects spend came to $777 million, down from last year’s record $1.04 billion. However, within that, foreign PDV work hit a new record at $335 million. Spend on foreign shoots dropped to $442 million, compared to the record high of $793 million in the previous financial year, but remains well above the five year average. Foreign titles to shoot in Australia included Ticket to Paradise, Nautilus, La Brea season 2 and Young Rock season 2.

With unprecedented levels of production have come documented skills and capacity gaps. Screen Australia is part of the working group with the Office of the Arts, Ausfilm, the state agencies, NIDA and AFTRS that is looking to build a national framework on skills.

Further, Mason adds that with the Department for Communications and the Arts, Screen Australia plans to take an overview role across the sector to determine where key gaps are. Together they will then use their position to coordinate responses across other agencies, education providers, the broadcasters and large production companies.

In terms of where the money was spent, NSW captured the lion’s share – a state record of $1 billion or 45 per cent, though Victoria also reached record high of $556 million. Collectively, production in the ACT, NT and Tasmania tripled from $18 million to $57 million – another record.