Fewer big-budget international TV and Australian theatrical features have caused a near 30 per cent year-on-year decline in the amount spent on scripted content in Australia across the last financial year, Screen Australia says.

The agency released its 2023/24 drama report this morning, documenting the production of local and international features, TV/VOD, children’s drama titles, and PDV activity across the past financial year.

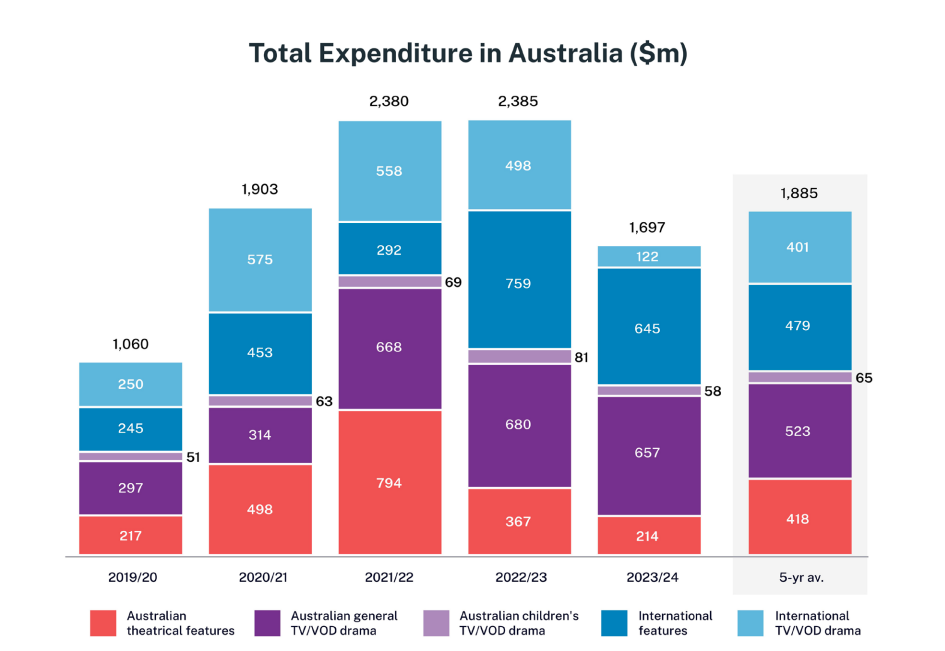

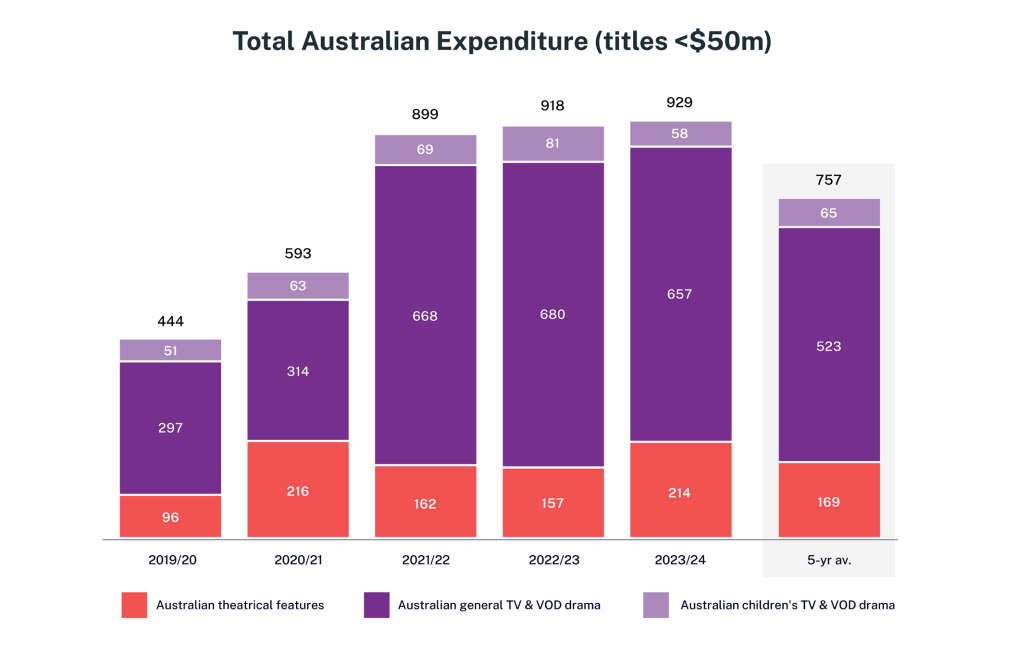

According to the data, $1.697 billion was spent on 169 productions in 2023/24, of which $929 million went into Australian titles, representing 55 per cent of the total. The remaining $768 million came from 70 international productions.

It’s a marked drop from last year, where $2.34 billion was spent across 213 titles. Australian projects made up $1.13 billion, and $1.22 billion was spent on 96 international titles. The year prior saw a record $2.43 billion spend, led by blockbusters such as George Miller’s Furiosa: A Mad Max Saga and Michael Gracey’s Better Man.

Whereas the previous two reporting periods were defined by a production boom, largely fuelled by foreign spend, 2023/24 heralded a contraction of the global market, as disruption across distribution platforms, business models, audience shifts, and the US actor and writer strikes took their toll.

Screen Australia CEO Deirdre Brennan said the 2023/24 figures still represented a solid result, following a “three-year peak driven by Australia’s status as a COVID-safe filming destination, streaming growth, and a number of high-budget theatrical features”.

“This year’s results confirm key trends in domestic activity, a contraction of free-to-air commercial TV drama and the increasing role of SVOD commissioning,” she said.

“Children’s content continues to face significant pressure and remains reliant on government support, so we’re working to broaden the opportunities for development of Australian kids IP.

“We will also explore the needs of feature filmmakers working in the $1-5 million budget range, dominant again in this year’s data.”

The report indicated that while 36 Australian theatrical features commenced production, an increase of two from the previous year, the total spend of $214 million reflects a 42 per cent decrease from the previous year. An absence of high-budget Australian titles in production meant funding accessed via the Australian Producer Offset was down from $124 million in 2022/23 to $75 million in 2023/24.

The absence of high-budget titles also impacted international investment in both Australian and international productions, with spend down 68 per cent year-on-year to $59 million. The bulk of theatrical features – 44 per cent – were produced with a $1-5m budget range.

Expenditure on first-release Australian subscription TV and SVOD content grew 17 per cent to $467 million, with the amount of titles increasing 29 per cent to 27 titles. Stan was once again the biggest contributor with 12 titles, followed by Netflix and Binge with four titles each, Paramount+ and Amazon Prime with two titles each, and Acorn and Adult Swim with one apiece. It comes amid questions over the Federal Government’s streaming regulation, under which content quotas would be introduced for streaming services that operate in Australia, which was initially set for July 1 but has been delayed.

Screen Producers Australia CEO Matthew Deaner said the data provided concrete evidence of the need for Australian Government action across various areas.

“First and foremost, we urgently need the government to stand up for Australians against powerful global interests and put some fair and reasonable local content rules in place for streaming services,” he said.

“Other priority areas include the need for increased funding for ABC and SBS to put a strong foundation in the cultural building blocks of drama, children’s and documentary programs, and increased funding for Screen Australia. No government can look at these figures and conclude that all is well in the Australian screen industry. Australian audiences deserve to see and hear their own stories on all platforms.”

A total of $188 million was spent on 15 Australian general FTA TV and BVOD titles – down 32 per cent on last year – $3 million from 13 AVOD, TVOD, and other titles – down 49 per cent from last year’s record high.

Public broadcasters invested in fewer drama titles this year but still comfortably led their FTA/subscription counterparts, with ABC contributing to 13 titles, while SBS and NITV had four titles each. Of the other platforms, Network 10 contributed three titles, and Seven Network and Foxtel to one title each.

The ABC also continues to drive the commissioning of children’s content, which remains in decline, following the removal of minimum requirements on free-to-air television in 2020. In 2023/24, $58 million was spent on children’s TV/VOD titles – 29 per cent below last year – with the number of titles decreasing from 12 to eight this year, and hours produced declining by 42 per cent to 35 hours. Of the eight titles, five were commissioned by the ABC, one by Ten, one by Stan, and one by Facebook/YouTube.

The Australian screen industry overtook foreign investment as the main source of financing for TV and VOD content in 2023/24, with a contribution of $252 million, accounting for 34 per cent of total finance.

As part of the Drama Report, Screen Australia examines Australian expenditure from PDV services for domestic, and international shoots and international PDV-only feature film and TV/VOD titles.

This year’s total of $589 million – comprising $325 million on 104 international PDV-only titles, $233 million on PDV for Australian productions, and $31 million on PDV for international shoot titles – represents a 17 per cent decline on last year but is still 15 per cent above the 5-year average.

Areas of growth detailed in the report include the production expenditure of Western Australia, which more than tripled to reach $77 million, as well as a record combined spend of $105 million in the Northern Territory, Tasmania, and the Australian Capital Territory, mostly driven by production activity in the Northern Territory and Tasmania, both of which hosted Netflix productions.

Looking forward, Brennan said Screen Australia would “continue to collaborate with industry to identify growth opportunities and ensure Australian screen stories thrive”.

“In an environment where international financing is also increasingly harder to source, we need to pull together as an industry to ensure the sustainability of the sector,” she said.

“Despite these challenges, we’re optimistic about the future and confident that there will be an uplift in production in the year ahead.”

Find the full report here.