The 2017 calendar year saw the independent screen production sector generate $1.2 billion in production revenue, export $163 million and support around 20,000 jobs. However, more than 20 per cent of production companies reported a loss and nearly 50 per cent only small profit. Almost one in 10 report they are worried about staying afloat over the next five years.

These are among the key findings of Screen Producers Australia’s (SPA) inaugural industry survey, conducted by and complied into a report by Deloitte Access Economics.

The report is informed by the results of two surveys – one, of independent film and television production businesses, of which there were 74 respondents, and the other of productions that commenced principal photography in 2017, which received 218 responses.

When SPA first announced the survey in April, it said it was looking to deliver an insight into the health of the screen production sector and track trends with regards to employment, trade and investment. It’s the organisation’s intention that the survey be run annually.

The report suggests that the performance of the independent production sector is uneven, with larger businesses performing well, but many smaller businesses struggling.

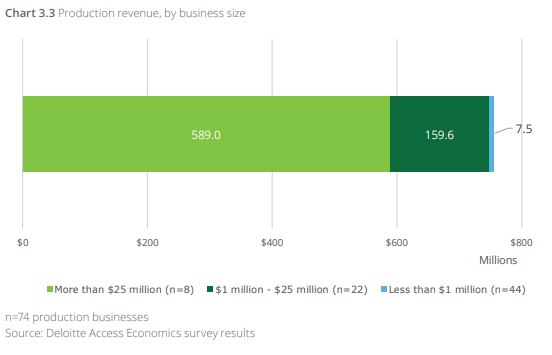

Companies with more than $25 million in annual production revenue made up only 11 per cent of those surveyed, but 80 per cent of the total revenue. Fifty-nine per cent of businesses surveyed generated less than $1 million in annual revenue, making them responsible for than 1 per cent of the total revenue.

Of the content produced by businesses with revenue over $25 million, 70 per cent was unscripted. The report notes smaller businesses (<$1 million revenue) were more likely to produce drama than larger businesses.

“Businesses accrue production revenue primarily when in production. As such, those without a broad slate may experience peaks and troughs in revenue, which can be difficult to manage,” it said.

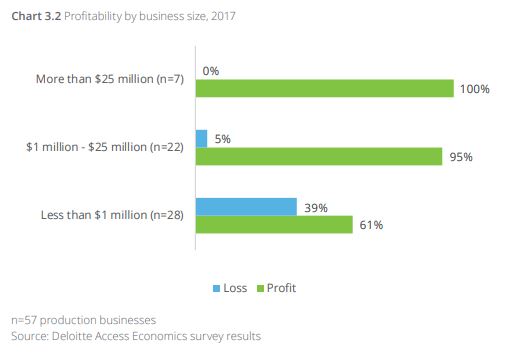

Of the businesses surveyed, 22 per cent made a loss last year, while another 48 per cent only made a slight profit.

The report suggests this is not a recent phenomenon, with 41 per cent of businesses reporting that their profitability was similar five years ago, and 30 per cent reporting narrowed margins.

“This could even understate the issue; some production companies have gone out of business in the last five years, and so will not show up in the survey results. For example, Keo Films, the production business responsible for documentaries such as War on Waste and Struggle Street left the industry in 2017,” the report says.

However, all larger production companies with revenues over $25 million recorded a profit. Thirty-nine per cent of companies with revenues less than $1 million made a loss, as did 5 per cent of companies with revenues between $1-$25 million.

More than 40 per cent of businesses surveyed exported their work overseas, with this making up 14 per cent or $163 million of the total revenue figure. The largest export market was the UK, accounting for over half of all exports, followed by the US and the rest of Europe.

As may be expected, larger production businesses with revenues over $25 million were more likely to export (88 per cent) than medium (68 per cent) or small (23 per cent) sized businesses. However, the report posits these figures are high when compared to Australian Bureau of Statistics data that shows only 7.6 of Aussie businesses export internationally.

Producers saw broadcaster bargaining power as the biggest challenge facing their businesses, with 44 per cent citing this as a concern. Thirty-four per cent cited high labour/capital costs as a challenge, and 29 per cent reported sector specific government tax policy, international competition and competition from VOD services.

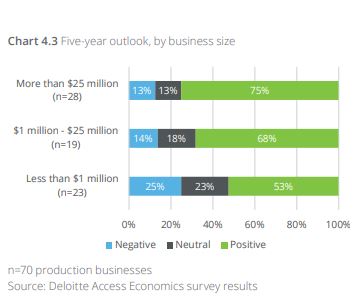

When asked about the next five years, 60 per cent of businesses expected to experience growth, while 21 per cent expect to reduce activity and almost 10 per cent concerned about solvency. Smaller businesses were more likely to have a negative outlook.

“Trends in consumption, globalisation and financing, as well as changes in the broader media landscape, are putting pressure on Australian screen producers,” the report says.

“Producers will need to continue to evolve in order to satisfy changing consumer preferences and adequately finance productions.”

SPA CEO Matt Deaner said the report was a “sober account” of the industry.

“Our industry is big and a significant employer. We’re outward facing and competitive in the global market for content; 14 per cent of revenue was export earnings. While some businesses are doing very well, many are not. This gives us pause for thought ahead of any changes to the policy framework,” he said.

The report comes as representatives of the Make It Australian campaign – spearheaded by SPA, the Media, Entertainment and Arts Alliance, the Australian Directors’ Guild and the Australian Writers Guild – are in Canberra to further lobby politicians to maintain the TV children’s and drama quotas, impose local content quotas on SVOD services and to better fund the public broadcasters and screen agencies.

Read the full report here.