Network Ten and Shine Australia have unveiled a new multi-year, multi-platform agreement which will keep the successful TV franchise MasterChef Australia at the network.

The new agreement with Shine Australia, which is for a minimum of three years, includes broadcast, online, mobile and IPTV rights for MasterChef.

"The ‘MasterChef effect’ is equally apparent in our digital media extensions: it's also been a huge success online and on mobile, both for catch-up and for Australia's millions of dedicated MasterChef fans who relish the chance to deepen their involvement with the show," Ten Network Holdings chief executive Grant Blackley said in a statement.

MasterChef, which was originally produced by FremantleMedia Australia, was first broadcast on Ten three years ago before FremantleMedia's chief executives' Mark and Carl Fennessy left to form Shine Australia last year.

They took the rights to the program with them and now also produce Junior MasterChef, The Biggest Loser and The Renovators, which will be broadcast later this year, for Ten.

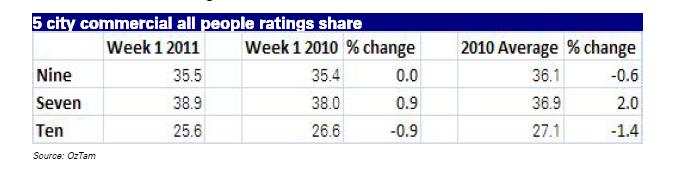

The news comes as the network posted an overall poor start to the year with a 25.6 per cent ratings share – down 0.9 per cent compared to a year ago – as it struggles to win audiences to its extended news coverage and US shows Hawaii Five-0 and Blue Bloods, according to Deutsche Bank analysts.

Last year, 4 million people tuned in to watch the finale of MasterChef Australia, which boasted a season average of 1.9 million viewers.

The Biggest Loser has been the star performer for Ten this year, attracting a 23 per cent higher audience compared to last year, according to OzTam data.

However, Ten has struggled this year with US shows Hawaii Five-0 and Blue Bloods attracting just 1 million and 700,000 viewers respectively.

“Of more concern is Ten's risky new strategy, especially the extended news coverage which has settled around 350,000 – 400,000 viewers (below the company's 500,000 target and the circa 1.1 million viewers on Seven and Nine news),” Deutsche Bank analysts said in a report released yesterday.

TEN's new digital multi-channel ELEVEN has had a reasonable start to the ratings with a 4.2 per cent commercial share (compared to Nine's Go at 4.8 per cent and Seven's 7Two at 5.2 per cent.

However, it appears to have been siphoned from its primary channel, which posted a 20.1 per cent share compared to an average 25.2 per cent share in 2010.

“Whilst it is too early to gauge the success of Ten's new strategy, the network will need a significant uplift in viewers in order to offset the higher costs associated with the new multichannel and the more comprehensive news offering,” Deutsche Bank analysts said.