The shifts that have characterised the pandemic’s impact on the screen sector are laid bare in PwC’s annual five-year media outlook, which forecasts an ongoing migration towards digital consumption.

According to PwC’s Australian Entertainment and Media Outlook 2021-2025, the country’s overall entertainment and media industry declined -3.6 per cent in 2020, with total advertising spend contracting by 8 per cent to $15.4 billion, and consumer spend dropping by 1.9 per cent to $42.5 billion.

The report identifies filmed entertainment as among the hardest-hit sectors, having experienced a compound annual growth rate (CAGR) drop of 41.0 per cent from $2.2 billion to $1.3 billion.

However, PwC notes the production boom resulting from Australia’s handle on COVID-19 has been a silver lining, as has the addition of new production facilities and studio services.

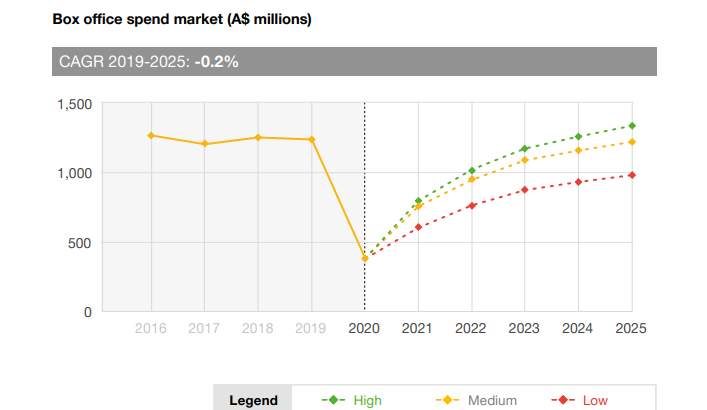

The company believes that provided the supply of blockbusters can resume, box office revenue is set to continue its recovery, reaching $1.2 billion in 2025.

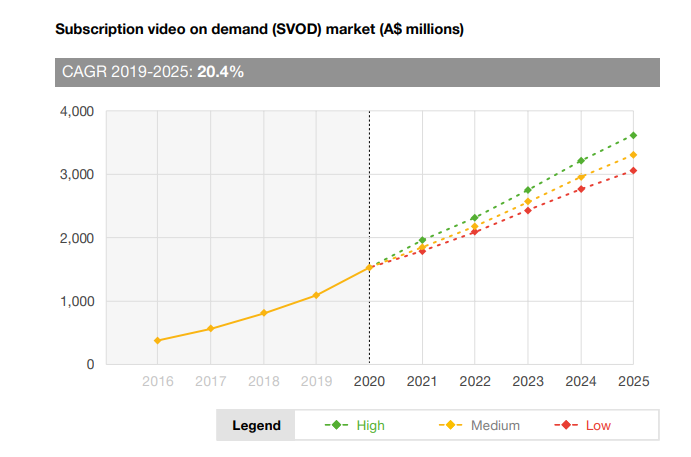

A 67.4 per cent drop in box office revenues in 2020 was contrasted by what PwC describes as increased availability, sector breadth and catalogue depth of the SVOD players and increased BVOD usage during the 12-month period.

According to the report, the streaming sector saw significant growth as established players such as Netflix, Amazon and Stan expanded their content libraries.

Contributing to that has been the introduction of Binge and BritBox, as well as attempts from relative newcomers such as Disney+ to try different business models, including Premium Video on Demand (PVOD) for new release movies.

PwC forecasts SVOD revenues will grow at a 20.4 per cent CAGR through to 2025, becoming a $US81.3 billion industry globally, and an estimated $3.3 billion in Australia.

At the same time, BVOD is expected to grow with a CAGR of 32.7 per cent over the forecast period to 2025, following revenue growth of 38.8 per cent in 2020.

The performance of BVODs are closely linked to that of free-to-air (FTA) networks, which, according to the report, saw a temporary increase in audience numbers during COVID-19, but were forced to navigate a simultaneous contraction of marketing budgets.

The data indicates that the total FTA advertising market declined -9.8 per cent in 2020, and that, within this, linear TV revenue declined -12.1 per cent to $3.1 billion.

However, the figures showed BVODs’ revenue contribution of $229 million was able to offset some of this.

Going forward, PwC expects the total market to return to growth in 2021. Linear TV is forecast to see a CAGR of -0.7 per cent to 2025, whereas BVOD continues to be the growth engine for the networks with a CAGR of 32.7 per cent to 2025.

PwC Australia partner Samantha Johnson said the increased use of non-advertising supported platforms was one of the “one of the most profound impacts we’ve seen from digital disruption in recent times”.

“The shift in weighting from advertising revenues towards consumer-generated revenues has accelerated, forcing a number of key players to rethink their business model, in a world where the expectation is that consumers can access an ad-free or personalised service, but they have to be prepared to pay for it,” she said.

Johnson said the “powerful shift towards digital consumption” would provide a strong boost to global growth in these industries for the next several years.

“As companies race to meet consumers where they are with an ever-expanding range of products, services, and experiences, the entertainment and media industries will grow more pervasive, more immersive, and more diverse.”