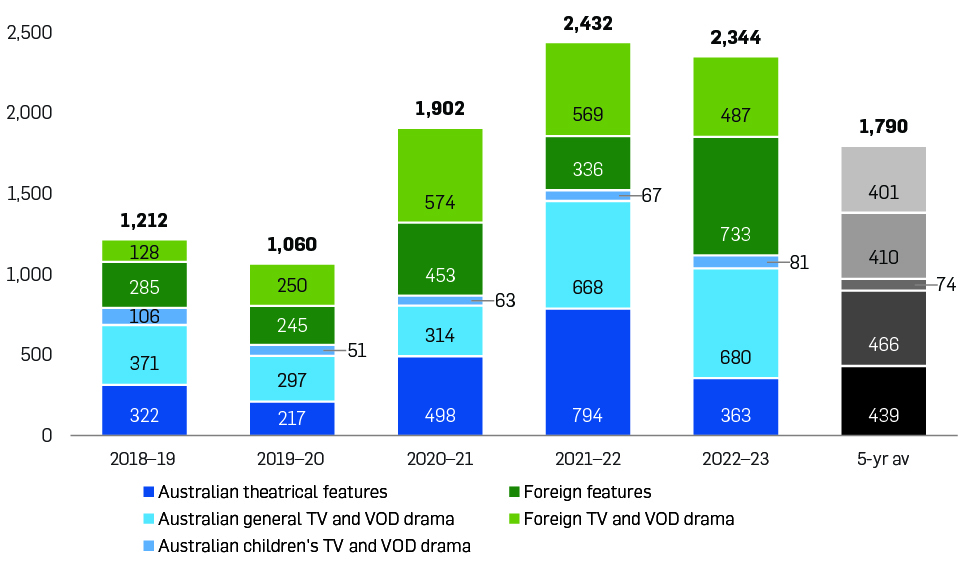

The amount spent on scripted content in Australia in the last financial year – $2.34 billion across 213 titles – is only a smidgen down on the prior year’s record high of $2.43 billion. Yet whereas 2021/22’s result was driven by unseen levels of expenditure on local drama, 2022/23 was fuelled by an all-time high in foreign spend.

Screen Australia released its annual Drama Report this morning, which details expenditure on all local and foreign drama production across film, free-to-air, VOD and online, including post-production and visual effects (PDV).

The money spent on Australian projects in 2022/23 was down 26 per cent to $1.13 billion, though it remains the second best year on record.

The decrease is largely due to significant slump in theatrical feature spend, and a decline in spend on local drama by the streamers. Bucking the downward trend were both free-to-air TV and children’s drama, though the spend in both sectors remains far below the levels seen prior to the the removal of the sub-quotas on commercial FTA in 2020.

Thanks to projects like The Fall Guy, Godzilla x Kong: The New Empire and Kingdom of the Planet of the Apes, international spend reached a record $1.22 billion in 2022/23 from 96 titles, up from $904 million in 2021/22. Most of that figure was driven by shoot spend, which reached $809 million from 16 titles, up 83 per cent on the previous year.

Foreign spend is always in flux, subject to the whims of the dollar, incentives and crew and infrastructure capacity. And when Screen Australia crunches the numbers on 2023/24 no doubt things will look a little different; Apples Never Fall and Mortal Kombat 2, both shooting in Queensland, remain struck due to the SAG-AFTRA strike, while the AppleTV+ series Metropolis, due to shoot in Melbourne, was canned altogether due to the writer’s strike and rising costs.

Indeed, the strikes have meant we are yet to truly understand how truly attractive the new permanent 30 per cent Location Offset actually is.

Reflecting on the topline figures in the Drama Report, outgoing Screen Australia CEO Graeme Mason tells IF the overall level of production is “massive”, but in terms of the spread of the spend, it’s a case of “swings and roundabouts”. For instance, last year saw record local feature spend due to films like George Miller’s Furiosa, while this year it is down, and concedes next year will look vastly different due to the lack of in-bound production. In that sense, argues the report should never be looked in isolation; to understand the pattern of what is going on in the sector, you need to across several reports.

Screen Producers Australia also urged a critical look at the report yesterday before its release, with CEO Matthew Deaner stating: “When I look at the Drama Report figures, my first question will be – who is benefiting here? And I wish the answer was, ‘Australia’, but that’s not the case. Australian creatives and businesses simply do not sit at the ‘negotiating table’ with anything near equal bargaining power.

“So much of what is being generated in this report is not remaining in the Australian creator’s ownership and control – and that is of critical importance to our local industry.”

Some 29 Australian features and two co-productions were shot in the last financial year, spending $363 million, down 54 per cent on 2021/22. That result is also 17 per cent below the five-year average. The number of theatrical features being made were similar to in 2021/22; so it follows that budgets are lower.

The majority of features, or 15, were made between $1-5 million, an increase of 36 per cent, while eight were made for $5-10 million. Foreign investment was the largest source of finance, typically from foreign distributors, followed by the Producer Offset.

On film, Mason says Screen Australia remains “watchful”, noting that the task of raising finance for independent features is harder than ever. While Barbie and Oppenheimer might be drawing people back to cinemas, box office for indie films remains depressed since COVID – whether those films are Australian or otherwise – and that means the value of sales have come down too. The agency also has more demand on it for production funding than ever before, with Mason noting it had 14 features to consider at the last round, when it may normally have five or six, and can typically afford to finance two or three.

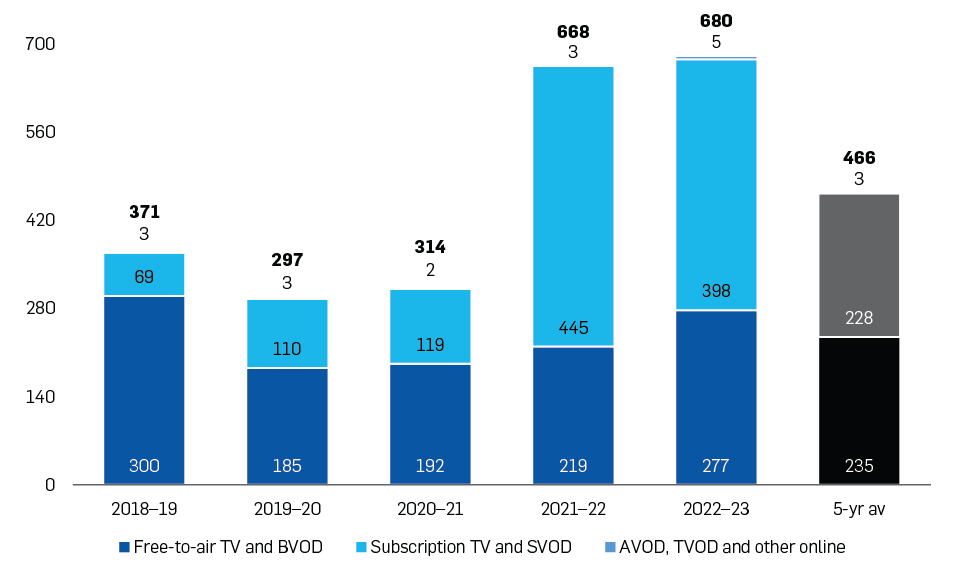

Expenditure on first-release Australian subscription TV and SVOD content dropped 11 per cent to $398 million, and there were less projects made; 21 compared to 30 in 2021/22. However, what was made was made at higher budget; seven out of the 21 titles had budgets in excess of $20 million, compared to eight of 30 in 2021/22. Hours were also down 17 per cent, from 136 to 114. The average cost per hour was $3.5 million.

Stan remained the largest commissioner in the space, ordering eight, or 38 per cent, of titles and making up 33 per cent of the total hours. Netflix, Disney+, Paramount+ and Binge each ordered three drama titles, while Amazon Prime Video ordered just one.

Last year, Mason told IF he was buoyed to see more SVOD platforms entering the Australian market and commissioning local productions, but cautioned “one year does not a pattern make yet”. He hasn’t changed his mind this year, even if the platform’s spend is still 74 per cent above the five-year average and makes up the largest proportion of all TV spend. Indeed, he is dismayed to see a decline in expenditure and hours at a time when that sector is growing dramatically, and when the platforms continue to derive significant subscription revenue out of Australia.

“It’s a growing area and they’re contracting in all three things we measure: hours, titles and spend,” he said.

“This is also a moment when there’s more [platforms]. That means there’s more subscription fees going out the door. Some of them are introducing advertising revenue, so they’re going to take that away from the free to air and other places.

“I am delighted they’re here, I’m delighted they’re making content, but they certainly don’t get a hall pass yet.”

FTA TV and BVOD expenditure reached $277 million in 2022/23, the highest level since 2018/19. At 29, the number of titles were up 21 per cent on the previous year. Hours also increased 16 per cent to 328. Cost per hour increased 9 per cent, with series and serials averaging $500,000, mini-series $2.1 million and telemovies and single-episode shows $1.9 million.

The ABC ordered the largest number of drama titles at 11, though Seven and 10 had the largest proportion of hours due to Home and Away and Neighbours, respectively.

As with 2021/22, Mason notes there continues to be “bleeding” between SVODs that are affiliated with an FTA channel, like Nine and Stan, or 10 and Paramount+, that makes reporting difficult. And now there is also there is the “unusual” bleed between 10 and Amazon for Neighbours – 10 is the first-release platform for the show but it is not necessarily the largest investor.

“That is a challenge for Screen Australia at the moment. We’re looking at: what are we actually reporting on? Who do we give the ‘benefit’ to, if you like, of that hours and spend?”

Children’s TV expenditure reached $81 million compared to $67 million in 2021/22. However, as usual, the ABC did the heavy lifting, commissioning nine out of 12 titles, while 10 out of the 12 titles had Screen Australia funding involved. Netflix, NITV and 10 produced one kids show each.

Looking at the last five years, the ABC’s share of children’s TV titles has gone from 45 per cent to 75 per cent, despite the number of titles it makes each year remaining largely static, reflecting the 2020 removal of the sub-quotas.

In 2022/23 there were 60 hours of kids drama produced in Australia; in 2018-19 there were 167.

Mason argues kids is his “number one concern”.

“As a cultural agency, which helps people make content to reflect back to ourselves and shape our culture, if we don’t do kids stuff, we’re doomed. In a second, those kids, as they grow up, won’t have have what we all had, of experiencing our voices and stories. They’re not going to suddenly start watching them at 20 if they haven’t had them as kids.”

Mason wants to see the streamers enter the children’s space, but argues producers do need to be cognisant that children are also watching content online on platforms like YouTube. In that sense, he argues Screen Australia may need to step in and start fully funding or investing a lot more in such content upfront, given it can be difficult to monetise.

“Steamers need to be in the space. They need to be there culturally and I think they should be commercially. You need kids content on your streaming service if you’re selling into a local household where you’ve got a family.

“But I think if I was sticking around, Screen Australia would need to be looking very actively, as we do in the grown up space, what can we do on TikTok, Facebook and YouTube, because that’s where kids are. I don’t think it makes much sense thinking, ‘Oh my god, there’s only one free-to-air commissioning door.’ Yeah, there is, but there’s probably only one free-to-air space where kids are going.”

The largest source of finance for all TV and VOD content were foreign investors, making up 39 per cent of all finance, with 2022/23 seeing new record of $296 million spent. This was mostly from foreign broadcasters, VOD platforms and distributors.

PDV spend was up 21 per cent in 2022/23 to reach a record $714 million; 60 per cent above the five-year average. Notably, Australian titles made up $269 million of that number, up 34 per cent from 2021/22. Spend by foreign PDV-only titles, which included Ant-Man and the Wasp and The Magician’s Elephant, reached $407 million, while international titles that shot here spent $39 million. However, one can predict the PDV numbers will dip again for next year, given the US strikes.

For now, Mason is excited to see PDV numbers up so much, arguing it is a huge growth area for the industry in terms of jobs, with many providers having invested in training. “That’s a really great creative and commercial thing to see as a bedrock for our sector,.”

Post-production and VFX jobs, which are often full-time and long-term, are often better understood by governments. That said, the NSW Government recently axed its PDV rebate, only to reinstate it quickly after industry outcry. Mason argues that speaks to a broader issue, one he will “take on the chin”.

“Screen Australia and the sector need to ensure we clearly explain what we do [to the public and the government]. We are the number one cultural activity… but also, we are a huge business.”

Of the overall $2.34 billion spend, a whopping 56 per cent of it – or $1.3 billion – took place in NSW, a record for the third year running. Queensland also had a record year, capturing $581 million, 23 per cent above last year. Spend in Victoria and South Australia fell significantly, at 45 per cent and 52 per cent respectively.

Broadly, Mason is optimistic for the future of the sector, even in a contracting market.

In terms policy and funding implications for Screen Australia from the Drama Report, he notes there remains a huge gap between what it costs to make things and the finance that can be raised within Australia. He would like to see Screen Australia work with Screen Producers Australia and producers on avenues to international investment, including how to “make content in the right way that would access money”.

“I’m not saying making an international Euro-pudding. I’m saying making it Australian but make it in a way that attracts investment,” he says.

“And I still think there would be some stuff [Screen Australia] probably have to invest more in because if you’re going to really want to make something which is a ‘local, local’ story that can’t sell, you’ve got no alternative but then to put the money in.”