Emma Madison, head of commercial and industry services at Screenrights, is a leading expert in film and TV recoupment in Australia. Here, she offers an overview of financing structures and how they operate – and hopes to get you thinking about how the initial financing puzzle impacts long tail returns to the producer, investors and other revenue participants.

Composition of the financing structure

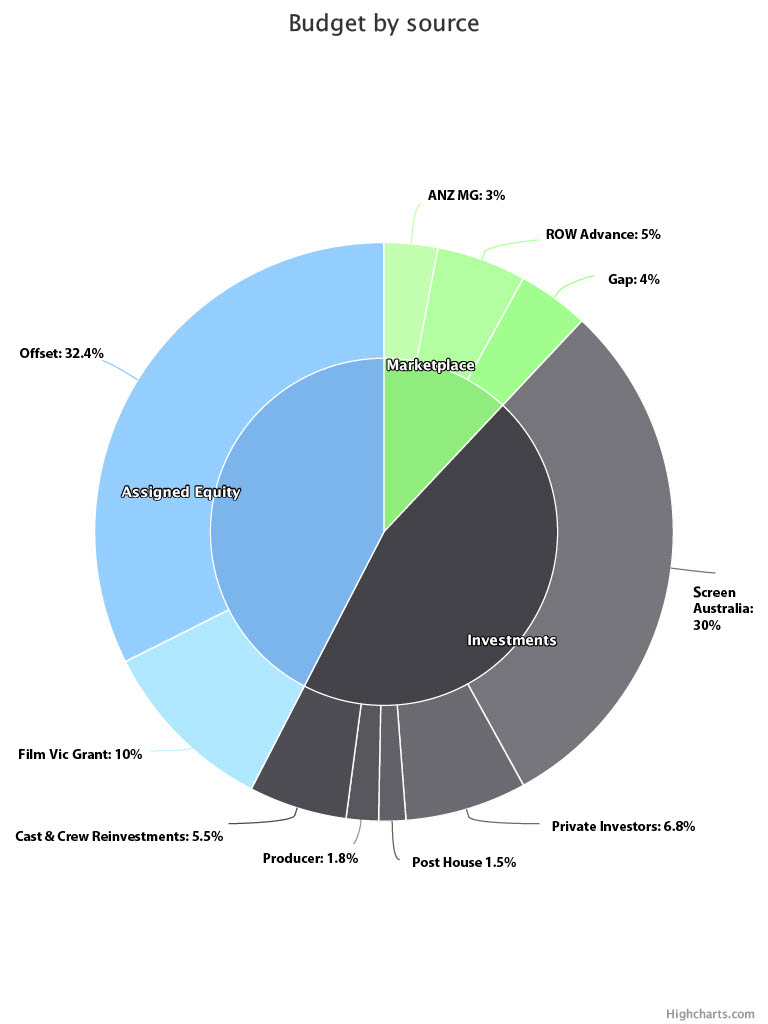

Looking at a screen project’s finance plan, it can help to break down its structure into three broad categories: marketplace, investment, and assigned equity.

Marketplace

Financing that is sourced from buyers or companies that are contracted to sell the project into domestic or international markets is called marketplace financing. Buyers can include a local broadcaster who pays a license fee, a local distributor who may pay a distribution advance, an international sales agent who may pay a sales advance, and foreign distributors who may commit to presales before the project is made.

The advances and presales can be conditional upon delivery, which means the payments are made after production and post. This causes a timing issue for the producer who needs the committed funds upfront to finance the budget. The producer solves this problem by getting a loan secured against the contracts it has with its marketplace partners and ‘cashflows’ the funds into the budget. The loans are repaid upon delivery and payment from the marketplace partners.

Marketplace financing also includes gap financing, which is a form of debt financing. Gap financing can be used in cases where the project is almost, but not 100 per cent, financed. The producer takes out a loan to cover the gap and that loan is hopefully repaid from future sales. This is risky as the sales are not guaranteed and the marketplace partners are likely to be in first position for recoupment ahead of repayment of the gap loan.

Different elements of marketplace funding play out in very different ways when it comes to recoupment. A licence fee, for example, is a straight sale and goes directly into the budget. But a sales or distribution advance is money provided against expected future returns, and will need to be recouped from sales in first position. The advances and the gap loan will often need to be repaid before the producer and investors see any returns.

Investment

‘Investment’ covers a fairly traditional use of the term, where investors will put money into the project with an expectation of a future return. Although some investors may choose to invest for a variety of reasons, the fact that they are investors means they have an expectation of financial returns on their investment. In Australia, typical investors include federal and state screen agencies where their contribution is not in the form of a grant; producers where they invest cash or make an in-kind contribution, broadcasters and streaming platforms where they invest an amount in addition to any license fee and in some cases, private investors.

Investors are entitled to an equity position in recoupment and a share of profits. The share they will receive is relative to the amount of money they invested as a proportion of the total investments by all equity investors.

Assigned equity

In Australia the producer will also likely be an equity investor even in circumstances where they do not directly contribute any cash into the budget. The producer ends up with equity by virtue of the fact that they bring cash to the project in the form of grants and tax offsets. I like to use the term ‘assigned equity’ to help understand this form of financing and the consequences for the producer in terms of their equity position and recoupment.

The concept of assigned equity is important to understand as it is through this mechanism that the producer can participate more fully in the financial performance of the project. The greater the proportion of the budget that is financed with grants and tax offsets, the greater the equity position of the producer.

The greater the equity position of the producer, the greater returns to the producer from the financial performance of the project.

Selling around the world

Domestic distribution

The way that film and TV projects are sold in Australia and New Zealand is through the local distributor. The producer enters into an agreement with the distributor and licenses rights for exploitation, such as theatrical, non-theatrical, free and pay TV, home entertainment, video-on-demand (streaming), electronic sell through (download-to-own or for a limited period), airline, and more.

Your distributor will have an extensive network of contacts with exhibitors and buyers. When they make sales, the money will flow back through the distributor, who will first take their commission and recoup their costs and any monies they advanced.

How the proceeds of the sales are described can differ by context. Proceeds from box office sales are called film hire, sales made to broadcasters and airlines are in the form of licensing arrangements so the proceeds from these sales are called license fees. Streamers may pay a licence fee, or they could have a revenue share model and pay royalties, or a combination of both. When your distributor makes home entertainment sales to retailers you will often be provided with information about units sold in addition to the amount of the sales, and in some cases there may be units returned and negative sales.

Rest-of-world sales

Outside of the local territory, the producer will often work with a sales agent or an international distributor. An international distributor takes on a sales agent function when it sells into foreign territories. For simplicity I’ll refer to them both as sales agents.

The sales agent will have extensive contacts around the world and they leverage those contacts to maximise exploitation of the film or TV show. The producer enters into an agreement with the sales agent and licences rights to exploit those rights for the rest of world excluding the domestic territory.

The sales agent carves up the available rights by type (theatrical, video-on-demand, etc) and territory. The way that they slice and dice the rights and territories will be unique to your screen project and its reception in the marketplace.

The sales agent will have a range of strategies available to them.

One approach is to seek to secure a global licensing deal with a major streaming platform. This would be a single large sale covering all rights and all territories following which there are no remaining rights left to exploit and therefore no further revenue for the film or TV show.

The sales agent may also elect to sell the title territory by territory to foreign distributors around the world who take all rights in their territory. The foreign distributor pays a minimum guarantee (MG) for those rights and on-sells to buyers in their territory.

Alternatively the sales agent may carve up rights further and sell just TV rights to broadcasters around the world, airline rights to in-flight entertainment buyers and video-on-demand rights to limited territory or non-exclusive streaming platforms.

There are many ways to carve up the rights but the goal is the same: to carve them up in the optimal way to maximise total sales from the exploitation of those rights.

Sales agents also recover expenses, take their commission according to their contract and recoup any advance that they made into the budget before money typically starts flowing back to the producer. Then the producer may have their own marketing expenses to recoup or other obligations to meet such as residuals. Once these are covered, funds can begin to flow back to the equity investors, including the producer and any other beneficiaries.

Recoupment

Recoupment plays out over time, and it can play out over many years. We usually see quarterly reporting for two years, followed by six-monthly reporting for two years, then annual reporting.

Your distributor and sales agent will seek to maximise early exposure and awareness to make as many sales as possible at that point. But then those rights will be tied up in each of those territories until those licences expire. So we’ll see a flurry of sales, and then smaller, less significant sales over time. Then after seven years you might start to see second cycle sales kick in as the original licence periods expire and some territories or classes of rights become available for relicensing.

The waterfall

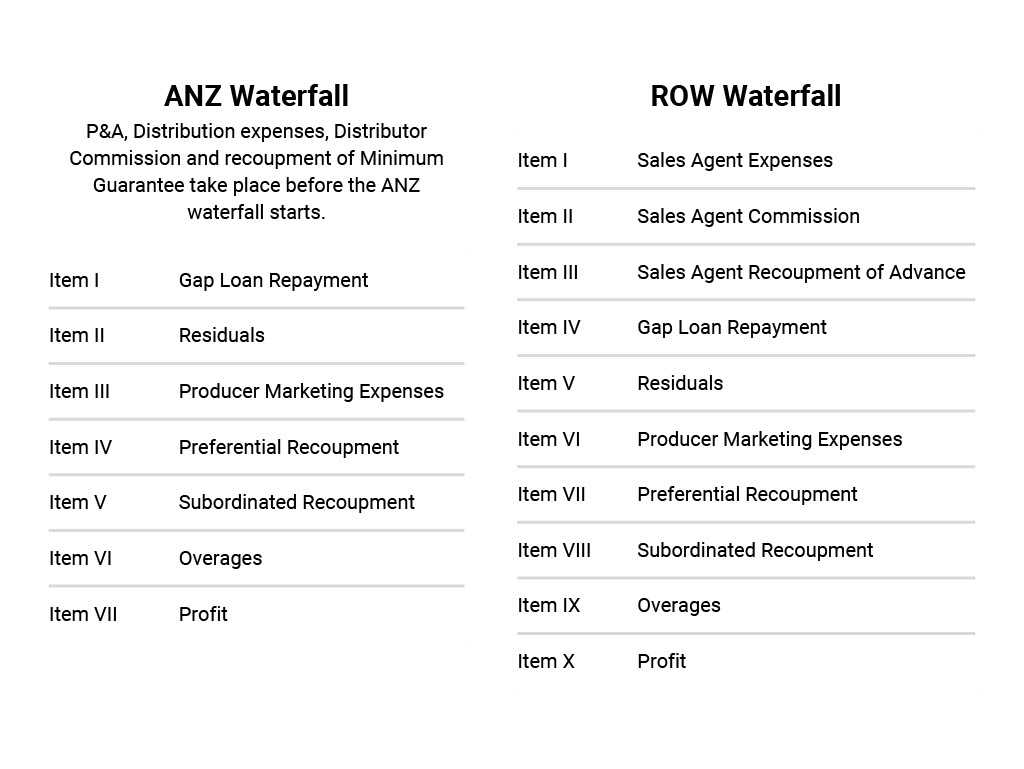

The recoupment waterfall can be thought of as a set of instructions that describe how proceeds from the exploitation of the film or TV show will be paid to the various beneficiaries. It includes the order in which different payments will be made, the splits between beneficiaries where they are being paid at the same time and any allowable deductions.

The recoupment waterfall is usually determined during the financing process. The version of the recoupment waterfall that appears in the collection account agreement will typically supercede all other versions for clarity. While the above table is a typical waterfall structure that we might see on projects that come through Screenrights’ collection account management services, no two waterfalls are the same because every project is different.

Producer-for-hire deals

Of course, where the producer enters into a producer-for-hire arrangement with a global streamer there is often a complete rights buyout. What does this mean for recoupment and the long tail? It means there simply isn’t any and the terms of the deal should be sufficiently attractive to account for this.

It’s complicated!

As you can see, finance plans and recoupment are complex beasts. Screenrights has a range of webinars available on demand, or can shape something suitable for your organisation. Recoupment and disbursements can be managed by producers and production companies independently, but Screenrights does run disbursement and collection account management services if you’d rather hand over the administrative burden.