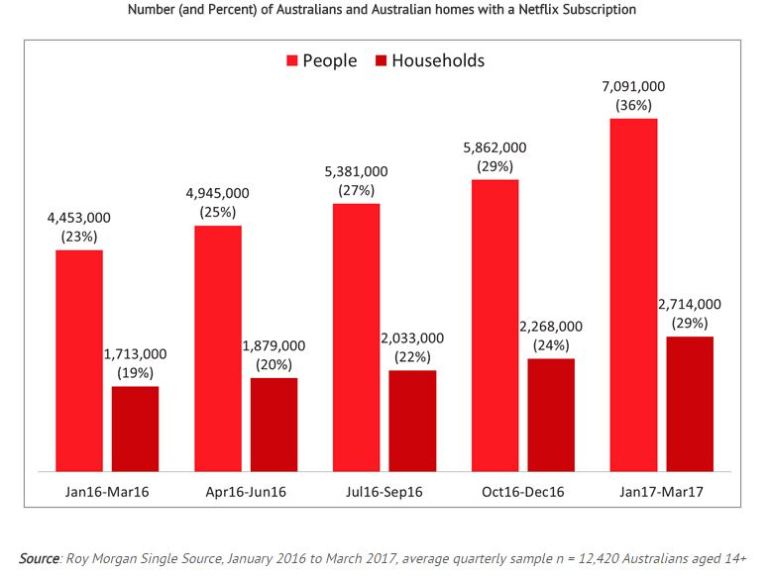

Netflix seems unstoppable in Australia, with more than 2.7 million homes subscribed to the service at the end of March – a penetration rate of 29 per cent, according to a new survey.

Roy Morgan Research (RMR) estimates Netflix posted a 20 per cent gain in subscribers in the first quarter, reaching nearly 7.1 million people aged 14-plus, up from 5.8 million in the previous quarter.

Those findings may be conservative, as some pay-TV executives believe Netflix has close to 3 million subs and that its universe will continue to grow despite the relaunch and rebranding of Foxtel’s streaming service Foxtel Now.

RMR’s study looked only at Netflix and did not include other SVOD players such as Stan (which has more than 600,000 paying customers), Amazon Prime, Hayu and NBA Season Pass.

Nor did it include Fetch TV, Australia’s largest OTT platform, which also offers Netflix and Stan and has more than 500,000 subs.

In February Fetch introduced four “skinny” channel packs, each priced at $6, comprising Kids (10 channels), Knowledge (17), Vibe (13) and Variety (9).

Some commentators predict Amazon Prime will become the second biggest SVOD operator in the market within two years, based on its hefty spending on original content, the $US99 per year subscription model with free shipping, and its success in the US where it has more than 50 million members.

Foxtel Now is expected to get a boost from the aggressive marketing campaign and from being available on Chromecast, with other devices to be added.

Michele Levine, CEO Roy Morgan Research, said, “The number of Australians with a Netflix subscription in the home grew steadily by just under 500,000 per quarter throughout 2016. In just the first three months of 2017, the SVOD powerhouse gained over 1.2 million new viewers via 446,000 additional household subscriptions.

“Clearly Netflix—and SVOD more generally—show no signs of slowing. Roy Morgan has been measuring Netflix in Australia since its beginning in early 2015. What we have seen is a classic case of rapid technological adoption, with early adopters signing up first, professional technology mainstream following close behind, and a continuation of high growth as younger digital natives, older tech explorers, traditionalists and even technophobes begin to discover the services.

“Netflix reportedly plans to spend around $A8 billion on content in 2017 alone—or more than the entire valuation of Foxtel, according to some industry markets analysts.”