Production in Australia is booming. In the last four years, productions supported by the Australian Screen Production Incentive – the three-legged stool of the Producer Offset, PDV (post, digital and visual effects) Offset, and the combined Location Offset and Incentive – have resulted in a whopping $16.5 billion of economic output, and in the last financial year alone, created 20,600 full-time equivalent jobs.

However, if the stool had a potential wobbly leg, it would be in the Location Incentive program.

A new report from Olsberg SPI, commissioned by the Australia New Zealand Screen Association, suggests Australia is “firmly placed at the top of the league” of countries where governments have recognised the economic and cultural benefits of supporting the screen industry, with policy settings in recent years leading to significant growth.

The report’s data shows that between 2018-19 to 2021-22, offset-supported production expenditure grew by 91 per cent, gross value added to the economy grew by 92 per cent, tax revenue was up 91 per cent and the number of full-time equivalent jobs was up 76 per cent.

For every $1 spent, the Location Offset/Location Incentive returned $5.89 to the economy, the PDV Offset $4.90 and the Producer Offset $4.40. The gross value added (GVA) from 2018-19 to 2021-22 was $5.9 billion.

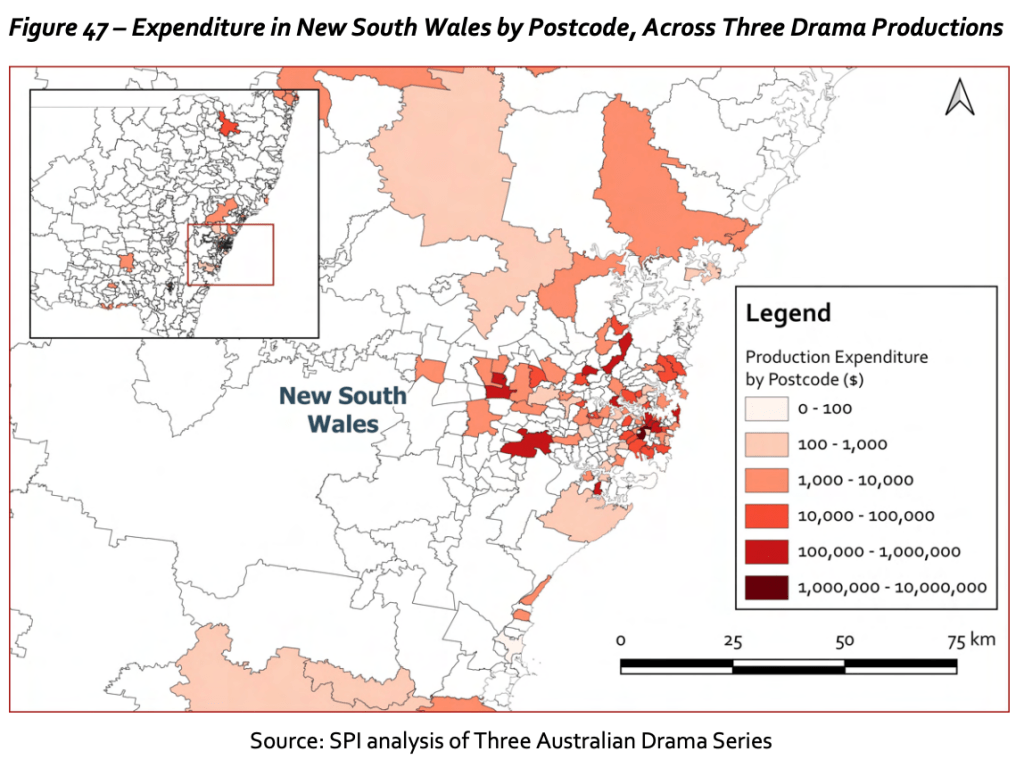

Countering the idea that screen production only benefits capital cities, production expenditure was also found to take place widely across states, and benefitted more than just screen-specific businesses. Analysis of three mid-budget Australian TV drama productions found 60 per cent of below-the-line spend went into other areas of the economy, including travel (12 per cent) and construction (8 per cent).

However, according to Olsberg SPI, the threat to this thriving three-tier ecosystem comes in the uncertainty created by the finite nature of the Location Incentive fund – it is likely to run out soon – as well as the complexity of its application.

“This doesn’t just risk location shoots in Australia, it also risks PDV work as PDV work is done in proximity to the location shoot, and – increasingly – captured in camera through volumetric sound stages,” the report states.

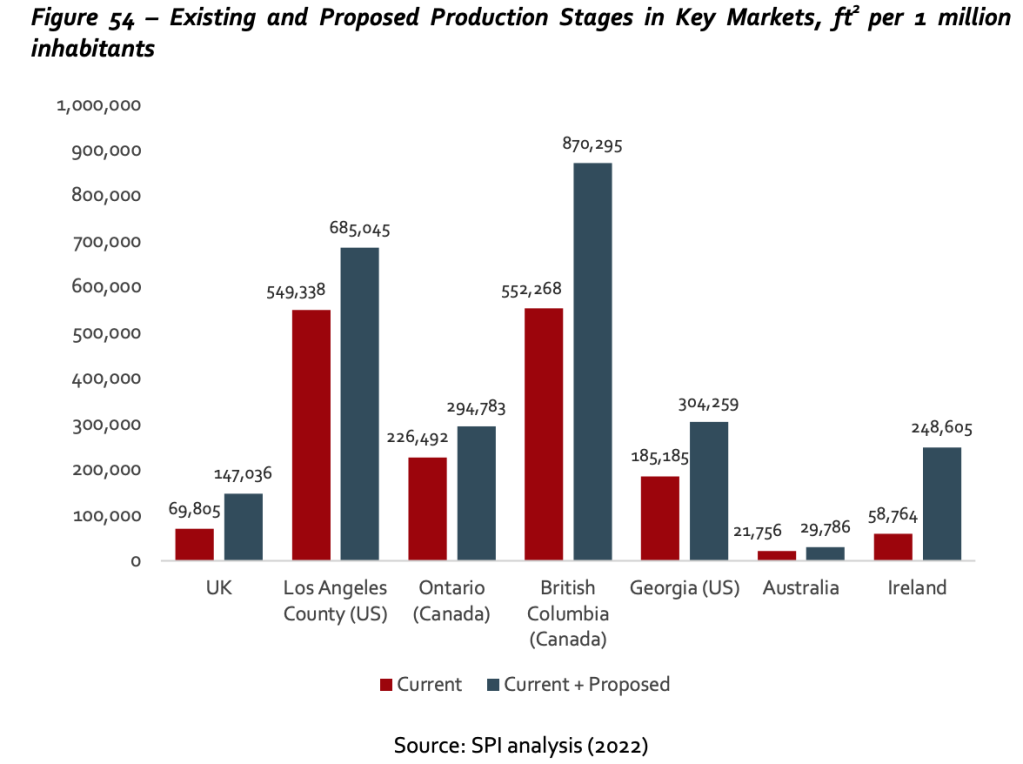

The report also suggests that compared to international competitors, Australia is “considerably underserved” when it comes to purpose-built studio capacity, and that the uncertainties around the Location Offset and Incentive are seeing investors, both domestic and international, hold back plans.

While there have been several announcements for new studios in the last few years, including government-supported stages in Perth and Cairns, development has been slow.

“Data from the UK and elsewhere evidences the fact that the necessary private sector investment in stages is almost impossible to achieve unless the incentive system supporting production is regarded as predictable, reliable, permanent and substantial,” the report states.

“Private investors considering studio expansions and new builds are concerned about the stability of the Location Offset and Location Incentive (and other funding available to incoming projects). This concern is inhibiting positive investment decisions in Australia.”

At 16.5 per cent, the Location Offset on its own has long been regarded as uncompetitive when compared to other territories. Calls to lift it to 30 per cent go back more than a decade to when the Gillard government was preparing its Creative Australia policy.

Prior to the introduction of the Location Incentive, projects like Aquaman, Alien: Covenant, Thor: Ragnarok and Pirates of the Caribbean: Dead Men Tell No Tales all had to be lured to Australia via additional, one-off cash grants.

The Location Incentive, when combined with the offset, effectively lifts what footloose production can receive to 30 per cent. It was initially launched in 2018 with $140 million to last until June 2023. However, the fund was quickly drawn down on and so topped up with a further $400 million in 2020 to last until 2027.

The most recent top up, combined with Australia’s relatively strong containment of COVID-19 and solid international reputation as a production destination, has led to the attraction of unprecedented levels of international production. Most recently, it has helped draw Ricky Stanicky and Apples Never Fall, as well as Metropolis, Kingdom of the Planet of the Apes, The Fall Guy and the Godzilla vs. Kong sequel.

There has been no official statement from government about how much remains in the fund, but it is estimated to be less than $128 million – meaning it will likely be extinguished well before 2027, if not early this calendar year.

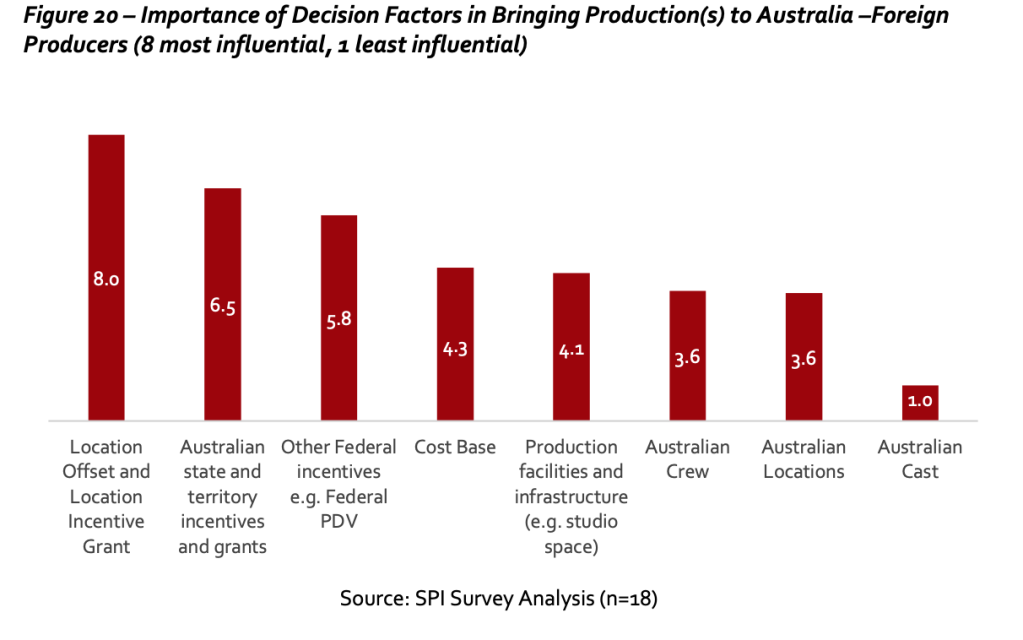

Olsberg SPI suggests that while the Location Incentive has provided more certainty than the previous top-up approach, it is still less certain and reliable when compared to incentives offered by the UK, Canada and the US state of Georgia. Further, while the Location Offset is non-discretionary and based on a threshold of spend (like the other two offsets), the Location Incentive is merit-assessed. That means it takes time to process, which has cost Australia projects.

It recommends that to grow levels of inward production the best option would be to increase the Location Offset to a higher permanent percentage.

A 30 per cent Location Offset has long been Ausfilm’s position, with CEO Kate Marks reiterating to IF that the figure has proven to be the right level to attract production and inbound investment.

“We believe that will provide long-term certainty to international investors and helps us guarantee the ongoing pipeline. It’s not just about the production coming in, it will also encourage both international and domestic investment into skills, into infrastructure and back into businesses. It’s all about providing that long-term continuity and business confidence,” she says.

Marks argues the PDV offset, particularly when combined with state incentives, is a great example of what certainty can bring; its PDV membership has grown by more than 50 per cent in the last five years. PDV-only work in Australia is at record highs, and the incentives have helped draw international players like ILM, MPC and most recently DNEG to Australia, and accelerated the growth of local companies like Rising Sun Pictures, The Post Lounge, Spectrum Films and Kojo.

The Olsberg report measures what it calls ‘additionality’; the degree to which production expenditure would have taken place in Australia should the offsets not have existed. For the Location Offset and Incentive the additionality rate is 100 per cent; essentially, those productions would not have come to Australia if the offset and additional fund were not in place. For the PDV Offset the additionality rate was 93.6 per cent, and Producer Offset 85.8 per cent.

When Jon Kuyper was senior vice president of physical production for Warner Bros, he tells IF that for every project, the studio budgeted for around three to five locations around the world.

“I hate to say it, but it is the film ‘business’ and cost obviously matters. It’s one of the deciding factors when it comes to where we’re going to shoot.

“Now, obviously the place has to have the appropriate infrastructure and resources, like crew, stages, and equipment. But even in the absence of those things, the financial elements of the location are always at the front of the argument,” he says.

Nowadays, Kuyper calls Australia home, having supervised projects like the The Great Gatsby, Mad Max: Fury Road, Gods of Egypt and more recently, executive produced Thirteen Lives and produced Woody Woodpecker.

As of last year, he has made a commitment to only work in Australia. He’s been consistently able to do that since the advent of the Location Incentive, but would still like to see the Location Offset permanently lifted to provide more certainty.

“That will pave the way for a decade or more of taking advantage of this boom of worldwide production… Australia is poised to take more and more of that global piece of the pie and bring it onshore. I think it’s really a win-win for everyone,” he says.

Kuyper echoes both Marks and the report in the belief uplift would have knock-on benefit for investment in sound stages and workforce capacity, pointing out that without certainty it’s difficult to make large scale investment into something like a studio that may take a decade to make returns.

Further, he emphasises that more international work is also good for the local industry, in that money spent on those productions is put into service businesses and talent. International productions train local crew to work at world class levels, and many service businesses would not stay afloat on domestic production alone.

“When when I put together [a local] independent film here… You have to ask for mate’s rates. That’s how these movies get made, because they don’t have these big budgets and you can’t pay full price. You need sometimes 40, 50, 60, 70 per cent discounts or favours. The only way those businesses and companies, and by the same token individuals, are able to offer those [rates] is because they just got a big fat pay cheque from an international job,” he says.

“Whether it’s Panavision, the studios, a production designer, an art director or a director of photography; those international pay cheques allow the ability to help pay back the local industry.”

As for local production, the report shows that Producer Offset expenditure has doubled since 2018/19, reaching a peak of $1.3 billion in 2021-22. The uplift of the TV PO to 30 per cent has seen a positive impact, and while final certificates may take longer than outlined to be issued, provisional certificates remain an advantageous tool for producers in raising finance.

Marks emphasises that the three offsets work as an ecosystem; all need to work effectively for the system to thrive.

“They work together to enable the industry to scale up and capitalise on the opportunity that is out there, which is just an ever increasing appetite for content.”

The full report is available here.